How To Find The Door In Identity Fraud

What are identity theft and identity fraud?

Identity theft is when someone steals your personal data (like your date of birth and card number) and so they can pretend to be you lot.

Identity fraud usually comes next – this is when someone uses your information for their personal gain. For example, they may access coin in your bank business relationship or take out credit in your name.

A whopping £706 one thousand thousand was lost to fraud in the Great britain between October 2017 and March 2018.

How tin can someone steal my data?

Here are 5 common ways fraudsters might steal your information:

-

Common theft – someone may steal your wallet or break into your habitation to take things like depository financial institution statements.

-

Phishing – fraudsters may create fake emails or websites to play tricks you lot into entering personal information.

-

Hacking – this happens when software is used to steal data from your phone, laptop or another device.

-

Phone scams – you could go a call from someone pretending to be a genuine arrangement, who so misleads yous into giving abroad important data.

-

Data alienation – your information could exist stolen from a business where you lot're a customer.

Nine ways to protect yourself

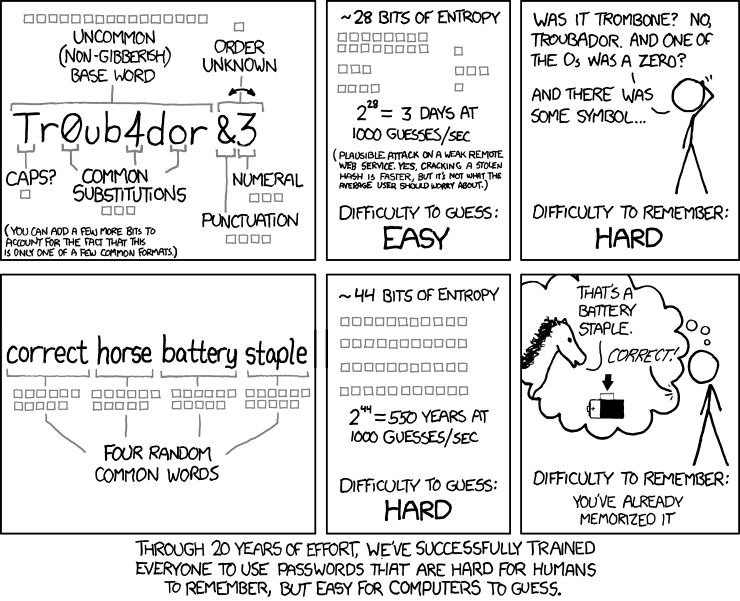

ane. Cull stiff passwords

A good password is ane that is unique and difficult to gauge. But unfortunately, good passwords are too difficult to call up! You can make this easier by using a password managing director similar 1Password, or making a password out of a serial of random words.

two. Keep your data off the web

Avert posting personal information on social media or websites where anyone can run across it. This includes things like your date of birth or national insurance number. About importantly, never post pictures of your banking concern bill of fare online.

3. Set upwardly multi-factor authentication

This can give you actress protection for important accounts and devices. You'll be asked to evidence your identity in more than one way when logging in – for example, with a countersign and a code sent to your phone.

4. Review your app permissions

Be cautious when allowing apps to admission your information and accounts. But share necessary data, and consider removing permissions for apps you don't apply anymore.

v. Remember before you click

Be wary of emails, websites, pop-ups and phone calls that could be false. For example, y'all may retrieve you're updating Adobe Flash when you're actually downloading spyware.

Look for suspicious signs – such every bit a unlike logo or spelling errors – and be wary of anyone who tries to worry you into giving them data. Avoid clicking on popular-ups when you lot're on a costless streaming site or public wifi, and apply ActionFraud to familiarise yourself with current scams.

six. Confirm that information's 18-carat by contacting your banking company

Don't trust information sent over e-mail, text message or phone. Fraudsters often transport texts that await like they come up from your bank, to trick you into revealing sensitive information.

If something looks unusual, confirm whether it's 18-carat by contacting your banking company.

7. Update regularly

Snoozing software updates? You could be putting yourself at gamble, as these often enhance security. Consider setting important apps and software to update automatically.

eight. Redirect postal service when you motility

If your mail is being sent to an sometime accost, a stranger could go concord of important data. You may want to set a mail service redirect with the post office to ensure this doesn't happen.

ix. Keep an eye on your transactions and credit score

If you lot do become a victim of fraud, the faster you notice the better. And then it'south important to regularly review your banking company transactions and investigate anything yous don't recognise. The Monzo app notifies you lot of new transactions as they happen, so you can answer immediately if something'southward not right.

Information technology'southward also smart to continue an eye on your credit score. If information technology goes down and you lot're not sure why, it could be that someone'due south taken out credit in your name. You can detect out more about credit scores and how to check them in our guide.

What to practice about identity theft

If your data'due south been stolen simply you haven't seen testify of fraud withal, there are several steps you lot tin take:

-

Place what information was stolen and what it could be used for

-

Change your password for important accounts, such as e-mail and online banking

-

Report and freeze a lost or stolen banking concern carte du jour

-

Written report lost or stolen documents (such as a passport or driving licence) to the organisation that issued information technology

-

Report attempted fraud to ActionFraud

What to practise most identity fraud

Report the problem immediately to your bank, credit providers and ActionFraud. Make sure to contact them directly using their official website, email accost or phone number.

If you bank with Monzo, you tin can get in touch with united states through in-app chat.

These organisations will give you communication on what to do next. Brand certain to continue a record of all calls and correspondence virtually the fraud.

For more comprehensive guides and helpful tips on how to make the about of your coin, follow Monzo Money Tips on Facebook!

Follow Monzo Money Tips

Source: https://monzo.com/blog/2018/09/21/protect-yourself-against-fraud-identity-theft/

Posted by: williamsuniagard.blogspot.com

0 Response to "How To Find The Door In Identity Fraud"

Post a Comment